Max Tenure

Loan tenure from 15 to 18 years

Max Amount

Funding available from Rs 10 lacs to Rs 10 crores

Quick & Efficient Processing

Get funds within 72 hours*

Flexible Repayment Options

Tranche based EMI and Part Prepayment Scheme

Attractive interest rates

Loan Against Property starting at 9.60%* rate of interest

Eligibility

- Self-employed Professionals:

• Doctors

• Chartered Accountants

• Consultants

• Architects Lawyers

• Company Secretaries - Self-employed non-professionals:

• Traders

• Commission Agents

• Contractors

• Age: 25 – 70 years of age

• Self-employed professionals and non-professionals need to show proof of a stable income.

• You must also be a resident of India to avail this loan.

- Proof of identity and residence:

- Proof of Income

- Property Documents

- Other Documents

Proof of identity and residence

- PAN

- Voter’s ID

- Driver’s License

- Passport

Proof of Income

- CA-attested ITR for previous 3 years (personal & business income)

- CA-attested Balance sheets and profit and loss statements for previous 3 years

- Savings account and current account statements

Property Documents

- Title deeds

- Allotment letter/buyer agreement

Other Documents

- Business Profile

- List of Chartered Accountants and Company Secretariats

- Complete details of pre-existing loans

- Passport-size photographs of all applicants/co-applicants

- Memorandum of Association and Articles of Association in case of a company

- Partnership deed

- Proof of own contribution

- Cheques drawn in favour of the loan provider to pay the processing fee

| Charge Type - Loan Against Property | Details |

|---|---|

| Processing Fee | Upto 3% on Sanctioned Amount + applicable taxes |

| Repayment bounce charges | Rs.1,000/- + applicable taxes |

| Late payment interest | 3% per month on overdue EMI |

| Annual Maintenance charges | NA |

| Duplicate NOC charges (Charge is applicable for paper copy post 3 free copies per customer) | Rs 250/- + applicable taxes |

| Repayment swap charges ( per swap) | Rs 500/- + applicable taxes |

| Additional documents charges -SOA/RPS/FC letter /Interest Certificate | Nil |

| Valuation Charges | As per actuals |

| Documentation Charge | As per actuals |

| Cash pickup charge | Nil |

| Interest Rate Conversion Charge | Upto 0.5% on Balance Loan Amt + applicable taxes (or) Minimum Rs.10,000/ – whichever is higher |

| List of documents | Rs. 300/- +applicable taxes |

| Providing Photo copies of the documents | Rs. 500/- +applicable taxes |

| Charges incurred by LTFL for initiating action under Securitization and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act 2002 | · Issue of Loan Recall Notice = Rs. 500/ – · Issue of Demand Notice = Rs. 1,000/ – · Issue of Possession Notice = Rs. 2,000/ – · Applying District Magistrate Order = Rs. 8,000/ – · Taking Physical possession = Rs. 20,000/ – Actual cost incurred will be debited for expenses pertaining to Publication of Possession Notice / Publication Demand Notice / Publication of Sale cum Auction Notice. |

| Legal / Recovery Charges (Other than pertaining to SARFAESI) | As per actuals |

| Loan Cancellation Charges | Rs. 5000/- + applicable taxes |

| Recovery of proportionate actual expenses from disbursement date(s), from individual borrower(s) in | LAP – Upto 1% of total disbursed loan amount + applicable taxes in case of closure within 24 months |

| Foreclosure / Full prepayment Charges – Loan Against Property | For Individual Borrowers – • Floating Rate – Nil Charges where end use is not for business/commercial purpose • Floating Rate – for cases where end use is for business/commercial purpose • Less than 1 year from disbursement – upto 3% on principal outstanding + applicable taxes • Post 1 year of disbursement – upto 2% on principal outstanding + applicable taxes • Fixed Rate – • Less than 1 year from disbursement – upto 4% principal outstanding + applicable taxes • Post 1 year of disbursement – upto 3% on principal outstanding + applicable taxes For Non – Individual Borrowers – (Applicant/Co – applicant) • Fixed/Floating rate loan – • Less than 1 year from disbursement – upto 4% principal outstanding + applicable taxes • Post 1 year of disbursement – upto 3% on principal outstanding + applicable taxes |

| Pre-payment Charges – Loan Against Property | For Individual Borrowers – • Floating Rate – Nil Charges where end use is not for business/commercial purpose • Floating Rate – for cases where end use is for business/commercial purpose • Less than 1 year from disbursement – upto 3% on Partial / Pre – payment amount + applicable taxes • Post 1 year of disbursement – upto 2% on Partial / Pre – payment amount + applicable taxes • Fixed Rate – • Less than 1 year from disbursement – upto 4% on Partial / Pre – payment amount + applicable taxes • Post 1 year of disbursement – upto 3% on Partial / Pre – payment amount + applicable taxes For Non – Individual Borrowers – (Applicant/Co – applicant) • Fixed/Floating rate loan – • Less than 1 year from disbursement – upto 4% on Partial / Pre – payment amount + applicable taxes • Post 1 year of disbursement – upto 3% on Partial / Pre – payment amount + applicable taxes |

| Charge Type - LAP - Dropline Overdraft and Hybrid Overdraft Facility | Details |

|---|---|

| Additional Interest | 2 % p.m. on overdue amounts |

| Payment Mandate Dishonour Charges | Rs.500/- |

| Foreclosure / Full Pre-payment charges | 5 % on outstanding Loan on the date of such full pre-payment |

| Part Pre-payment charges | Dropline / Hybrid Overdraft: • Not allowed till the day after the First Due Date. No charges applicable from the day after the First Due Date. • Part pre-payment of Loan toward limit reduction is not available |

| Annual Maintenance Charges (applicable only for Dropline Overdraft and Hybrid Overdraft) | 0.25% (+GST) of the Loan Amount as per the Repayment Schedule |

| Legal / Recovery Charges | Actual |

| Statement of account/ Repayment Schedule/ no dues certificate/ interest certificate | Physical copy at a charge of Rs.500/- +GST per statement/letter/certificate. Digital is NIL |

| Mandate Swap Charges | Rs.500/- + GST |

| Breakup between Principal & Interest | As per Repayment Schedule |

| Example of SMA/ NPA classification | More particularly mentioned under “Classification of Assets” under the head “Miscellaneous” |

Get your dream home financed today!

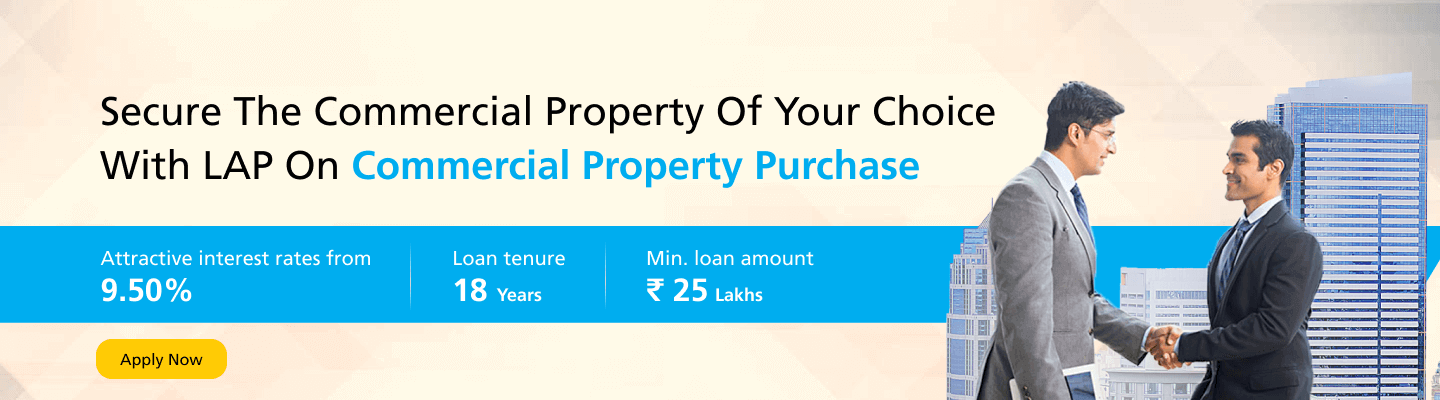

APPLY NOWLoan Against Commercial Property!

- Purchase Commercial Property

- New Office or Clinic

- Construction

- Transfer Loans

- LAP on commercial property purchase can help with the financial assistance for purchase of a fully constructed Commercial Property.

• Minimum loan amount for this facility is Rs. 25 lacs.

• Loan tenor is minimum 3 years to maximum 10 years.

• Individual properties where finishing work is pending due to specific requirement of customer may be considered.

- Commercial Properties

• New Purchase

• Resale - LTV

• LTV <= 85% of Cost of Property (COP) Subject to 60% of Market Value

• LTV <= 80% of Cost of Property (COP) Subject to 60% of Market Value

- Avail our commercial property loan to aid in the purchasing of a new office space for your business or a clinic for your practice.

- Wish to extend, improve or construct your own commercial space?

- Now you can do so with the commercial property loan. With the help of an LAP for Commercial Property Purchase take up renovations, beautifications or complete construction of your office space or clinic

- Incurring heavy interest expenses on your existing loan from another bank? Transfer your outstanding loan from any other bank or financial institution by using the LAP for Commercial Property Purchase.

Empowering Your Goals.

Housing Loan

I feel immensely grateful for your active cooperation and your cooperation has been outstanding and commendable. Without your contribution, it would be difficult for me to get my loan pass in a short period. Thank you for your untiring efforts and diligent work. Hats off for your support and guidance.

Housing Loan

It was indeed great to be associated with L&T Finance, the sales team here is very supportive and committed. Services provided are beyond delight and it was a pleasure interacting with them. The process of my home loan application was very simple and easy and the overall process was smooth.

Our Achievements

Home Loan And LAP

Home Loan And LAP

- Disbursements at ₹2,399 Cr in FY22

- Home Loan Approval (login to sanction): 20 minutes against industry average of 2 days

Share

Frequently Asked Questions

Have more doubts about home loans? Get all your queries answered here.

1. What features does L&T Finance Complete Home Loan offer?

2. What is the digitized process offered by L&T Finance Complete Home Loan?

3. What is the role of a dedicated relationship manager in L&T Finance Complete Home Loan?

4. In case of change of EMI, what is my revised EMI amount

5. How is loan repaid?

6. What is the processing fees?

7. How will LTF decide my Home Loan eligibility?

8. What is repayment tenure?

9. Can I start paying my EMI in case my loan is partly disbursed?

10. What is the tax benefit against my loan?

11. What is the minimum part prepayment amount that I need to pay?

12. Are there any part prepayment charges?

13. Will my rate change in future?

14. Where will I get my provisional/final interest certificate?

15. How does the floating rate change?

16. What is the rate at which I will get a Top Up loan?

17. How much loan can I get as Top Up loan?

18. Can I get an additional loan in my existing loan account?

19. While borrowing a Home Loan what are the questions that need to be clarified specially in the context of fixed and floating loans?

20. Are there any restrictions on transfer of immovable properties?

21. Does the Agreement for Sale have to be registered?

22. Does the Property have to be insured?

23. What security will I have to provide?

24. How frequently can I repay my home loan ahead of schedule?

25. Can I repay my loan ahead of schedule?

26. Do I need co-applicant for my home loans?

27. What are the LTV norms?

28. What is the tenure of a loan?

29. What are the work experience criteria?

30. What is the maximum or minimum loan amount that L&T Finance Housing Finance?

31. What is the age criteria?

32. When do I pay PEMI?

33. What is pre-EMI interest?

34. Will my tenure change or there is a change in the EMI if there is change in ROI?

35. When does repayment start?

36. What are the options for paying EMI?

37. What is the processing time of loan?

38. Who can be a co-applicant?

39. How can I increase my eligibility?

40. What are the eligibility conditions for a Home Loan?

41. What are the different types of Home Loans available from LTF?

42. Can I convert my floating rate loan to fixed rate loan or vice versa?

43. Can home loan tenure be increased?

44. What are the benefits of Home Loan?

At Your Service.

Reach out to L&T Finance on any device, across multiple channels.

Want a callback? Enter your details.

By proceeding, I confirm that the information provided by me here is accurate. I authorize L&T Finance and/or its authorized representatives to contact me for any queries and/or my documents collection for the loan application. This will override registry on Do Not Disturb (DND)/National Do Not Call (NDNC)

GET A CALLBACK

Know More About PLANET App

If you prefer Self Help Option (SHO) Click here

Corporate Office

Brindavan Building, Plot No 177

Vidyanagari Marg, CST Road,

Kalina, Santacruz (E), Mumbai 400 098

To visit a branch of L&T Finance please Click here

Connect With us on WhatsApp!

Send 'Hi' or 'Hello' to : +91 7378333451

Have more queries?

Get them answered instantly.

Customer Care

You may Call, SMS or e-Mail us for your loan related needs.

Personal Loans | Two-Wheeler Finance | Farm Equipment Finance | Warehouse Receipting Finance

[email protected] 1800-268-0000All days of the week (Except National Holidays) from 9 AM to 6 PM IST

.jpg?sfvrsn=ad8e7f11_1)